Heavy highway use tax explained for seasonal truckers and fleet operators

Heavy highway use tax explained for seasonal truckers and fleet operators

Blog Article

If you don't understand what e-file is, how it works or why you should do it you are not alone. Most people are in the same boat as you. The "E" in e-file stands for electronic which means your tax return is sent directly to the IRS. According to the IRS about 1 billion tax returns have been e-filed since 1990.

Vital Viral Pro is a traffic generation resource that is best suited for entrepreneurs that are already involved with home based opportunities. What makes VVP so awesome is 2290 tax form that it comes with a built in downline builder. Marketers can get their hands on banners, text ads, and branding materials to help them increase their incomes by growing their business.

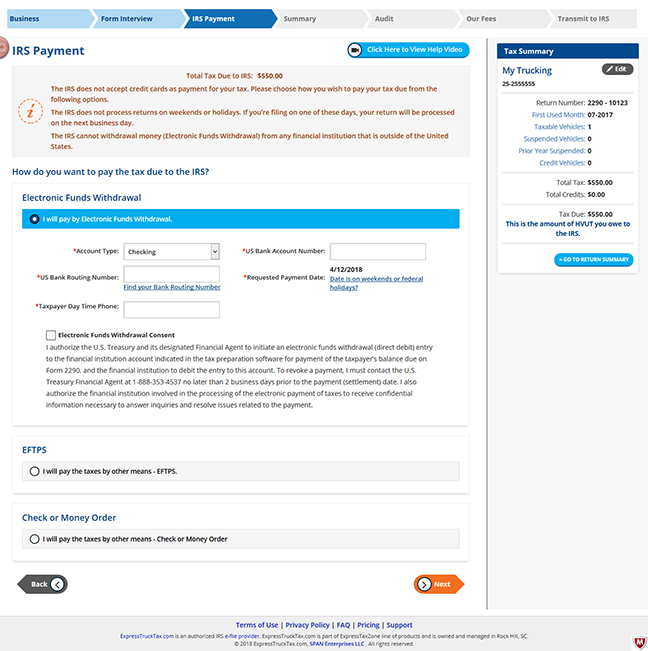

A Form 2290 online 2290 can be filed at any time after the deadline has passed but the tax due may be subject to penalties and interest. The penalty for failing to file IRS Form 2290 in a timely manner is equal to 4.5 percent of the total tax due, 2290 schedule 1 assessed on a monthly basis up to five months. Late filers not making an HVUT payment also face an additional monthly penalty equal to 0.5 percent of total tax due. Additional interest charges of 0.54 percent per month accrue as well. Once you have submitted your Form 2290, the IRS will stamp your Schedule 1 as proof of payment.

If you are really an expert in your niche, then article marketing is the best method to make money online for free. Just write a refreshing article with unique content and submit to quality article directories. Do not just promote your affiliate products in the articles with excessive promotional words such as blah-blah-blah. Have you ever observed the articles are placed on top of search engines for many of the keywords? This is because of their original content maintained on authentic directories.

The IRS heavy vehicle tax Reform Act of 1986 reduced the top rate to 28%, at the same time raising the bottom rate from 11% to 15% (in fact 15% and 28% became the only two tax brackets).

Direct expenses would include a dedicated business phone line, repairs or utilities that are for the dedicated work area alone, etc. These are deducted at 100%. (i.e., the window in your studio was repaired).

One more time, please remember that what I am giving you here is only my personal understanding of these topics. I advise you to get professional assistance.